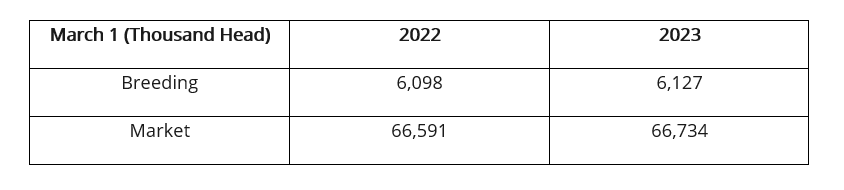

The March 1 USDA hogs and pigs report indicates production flatline with last year. Same number of breeding pigs and same number of market hogs.

You would think same number of pigs the market hog prices would be similar. Unfortunately for hog producers supply obviously goes with demand. Hog prices currently about $40 ahead lower than last year. Losses are at least $30 per head for most producers. Our industry has currently a real demand challenge. Pork cut-outs 77¢ lb., Beef cut-outs $2.80 lb. Someday we might figure out as an industry to start producing pork that tastes more like Beef rather than The Other White Meat.

The breeding herd declined from December report by 17,000, we expect further erosion as losses and the lack of optimism permeate our industry. A reflection of the financial reality is farrowing intentions down 1% March-May and down 3% year over year June-August.

We have believed that market hog numbers would be similar to a year ago. The inventory reports indicated the same. It’s somewhat bizarre that with European prices at record levels but more importantly about $100 per head higher than the U.S. that U.S. pork exports haven’t captured more of the Asian market. Maybe it’s a timing lag because you would think arbitrage would rule.

We are optimistic maybe to a fault, but we see the arbitrage to work for exports and the price difference between U.S. Beef and Pork too narrow as U.S. Beef supply plummets throughout the year. Last year summer we had hogs over $1.20 lb. with the same number of market hogs. Maybe we are delusional, but we still believe $1.20 plus is possible. Hope springs eternal but maybe it’s not a business plan.

Spain

Last week we were in Spain. We were in a market that is inverse of North America. While one market is losing $30-40 per head the other market making $30-40 per head.

We visited Genesus customers and attended FIGAN the major pork event in Spain. Spain has 2.6 million sows and is the biggest producer in Europe.

A year ago, Spanish producers were losing $30 plus per head as was all of Europe. Over the last two years Europe sow herd has declined 1 million sows and 12 million market hogs. Now most if not all European countries have hog prices at record highs. The saying “surest cure to low prices is low prices” comes to mind.

Spain’s industry is driven by family owned and driven family integrators. They have a passion for the business and their multiple families have pushed for their own and their countries expansion. Spain is the only country in Europe that has expanded in the last few years.

Today Spain is being challenged by new environmental, antibiotic, and animal welfare regulations.

Sows need to be in pens 2.2 sq. meters (24 sq. ft.)

Farrowing create space 6.5 sq. meters brackets (70 sq. ft.), and some expected to go to 8 sq. meters bracket (86 sq. ft.) plus must have farrowing pens

Finishing space over 220 pounds (100 kilograms) .75 sq. meters (8 sq. ft.) maybe going to 1 sq. meters (10.7 sq. ft.)

Antibiotic use has been next to eliminated. Zinc oxide has been eliminated

Spain’s main pig data system SIP indicates wean to finish average mortality has gone from 8% in 2019 to 14.4% in 2022, a 6.4% increase. In Spain that is at least four million more pigs dying compared to 2019. All these rules to be for animal welfare? Is mortality not an indication of animal welfare?

Spain sow mortality is similar to USAs at 14% which is also up in the last few years from 8%. Too lean of sows which lack robustness that can’t handle pen gestation continue to die at a faster rate. Spain has also been gifted sow prolapse issues by the world’s biggest genetic company compounding sow mortality. Prolapses Is Coming. Using genetics that can live is maybe a good idea.

Spanish producers we talked to are pleasantly surprised at the prices have reached over 2 Euros/kg. 99¢ lb. U.S. liveweight. Some believe price could reach 2.35 Euros/kg. $1.15 lb. U.S. liveweight. They could be correct. Their marketing hogs from last summer’s breeding’s. Europe saw herd decline about 300,000 sows since then. Less hogs with continued high mortality are cutting numbers. Spanish Packers are chasing hogs to fill kills, pushing hog prices up and hauling hogs from other parts of Europe to try to fill shackle space.

Spain average current cost of production 1.86 Euros/kg liveweight (93¢ lb. U.S. liveweight)

Feeder pigs current price for a 20 kg. pig is 110 Euros = 40 lb. pig is $120 U.S.

Summary

Europe and USA’s prices at $100 per head difference is the greatest spread ever. Both areas are major pork exporters. It’s not if but when USA exports increase from a combination price advantage and supply (less pork in Europe less to export). Maybe we will have to fall on our sword, but we don’t believe arbitrage is gone from the pork industry.

Genesus team present at FIGAN 2023 in Zaragoza, Spain

Cured Hams hanging at a plant in Spain

Yevgen Shatokhin, Genesus Official Representative in Ukraine and Kazakhstan:

+380 (50) 444 2633

shatokhinyevgen@gmail.com