At the end of December the USDA estimates U.S. Pork in cold storage was 408,361 (1,000 pounds) a year. A year ago it was 580,464. Down 30% and a ten year low.

In our opinion a sign of good pork demand, and bullish for the future lean hog prices.

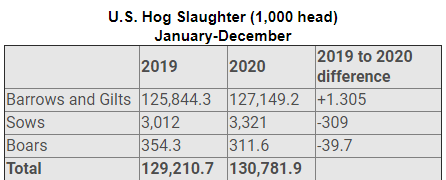

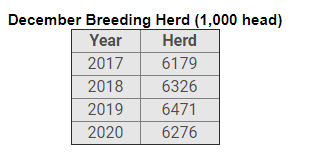

The U.S. January-December 2020 numbers tell the story - more barrows and gilts and more sows to slaughter. The sow number of 3,321,000 up 309,000 year over year can be seen in the December Quarterly Hogs and Pigs Report with the 2020 breeding herd down 195,000 for the year.

Some Farmer Arithmetic

The sow herd increased from Dec 1 2018 to 2019 by 145,000. The sow slaughter that year was 3.012 million sows.

In 2020 the Dec 1 breeding herd decreased year over year 195,000, with a 2020 sow slaughter of 3.321 million.

3.012 (2019 sow slaughter) + 145 (2019 breeding herd increase) = 3.157 (total) ÷ 52 weeks = 60,711 (breeding herd equilibrium).

3,321 (2020 sow slaughter) - 195 (2019 breeding herd increase) = 3.126 (total) ÷ 52 weeks = 60,115 (breeding herd equilibrium).

For what it’s worth analyzing the last 2 years of sow slaughter and breeding herd change we come with a sow slaughter on the 60,500 range per week average that would indicate a breeding herd staying about where it’s at. Above 60,500 it means liquidation. First 2 weeks of 2021 it has been 70,000 and 67,000.

Of note, last December-March the U.S.D.A. March 1 Hogs and Pigs Report indicated a Breeding Herd decline of 96,000 year over year. This year December was 18,000 higher sow slaughter than last year. All points to an indication of continued breeding herd liquidation.

It’s Farmer Arithmetic but it is what we figure.

The ASF Challenge

We have been doing business in Russia twelve years. Russia has been fighting ASF for over that length of time. Russia has massive land base and newer farms with good bio-security protocols. Still, they have not stopped ASF.

Recently, two large breaks - one near Moscow and other near Kursk, has led to a reported half a million pigs being killed including thousands of sows. To us this shows the challenge of stopping ASF. Russia’s structure should give it an advantage to do so.

When we compare Russia’s industry to China’s size and structure, the challenge to control ASF seems daunting. A person who works full time with China’s Swine Industry told us the other day “ASF is rampant still.” A big challenge.

When people look at China's swine production increasing, we are not sure if the ASF equation is being factored in.

Currently in China, a commercial market hog is fetching over $600 U.S. a head. Certainly a sign of demand outstripping supply.

Other Observations

U.S. Pork Cut-outs closed Friday at 85.36₵ lb. Real strong price considering slaughter numbers of 2.658 million. Pork Cut-outs are 85.36₵ lb., Choice Beef Cut-outs $2.33 lb. Pork is a great deal cheaper relative to Beef. Maybe get better tasting Pork to compete with Beef might not be a bad idea? Why do people pay more for Beef? Taste! Doubt it’s because they want to just spend their money.

U.S. Chicken production continues to run lower than a year ago. About 1% lower egg sets, chicks placed, and slaughter. Chicken has for years had steady production increases. This slow down now means less meat available. Good for Pork price support.

U.S. cash early weans averaged $61.48 last week – 8 months ago they were $5.00. What a crazy business! All indications are there are lots of finishing spaces chasing less pigs available to fill them.

You can’t cut breeding herd and have major health breaks (PRRS) and not have fewer pigs. With sow herd liquidation continuing we expect even less supply in future. This is going to lead to even fewer market hogs.

We believe that current lean hog futures are underestimating supply-demand. We will not be surprised to see lean hogs over $1.00 a lb. this summer. With current feed prices we will all need it.

Yevgen Shatokhin, Genesus Official Representative in Ukraine and Kazakhstan:

|

+380 (50) 444 2633 |

|

shatokhinyevgen@gmail.com |

|

genesus.com |