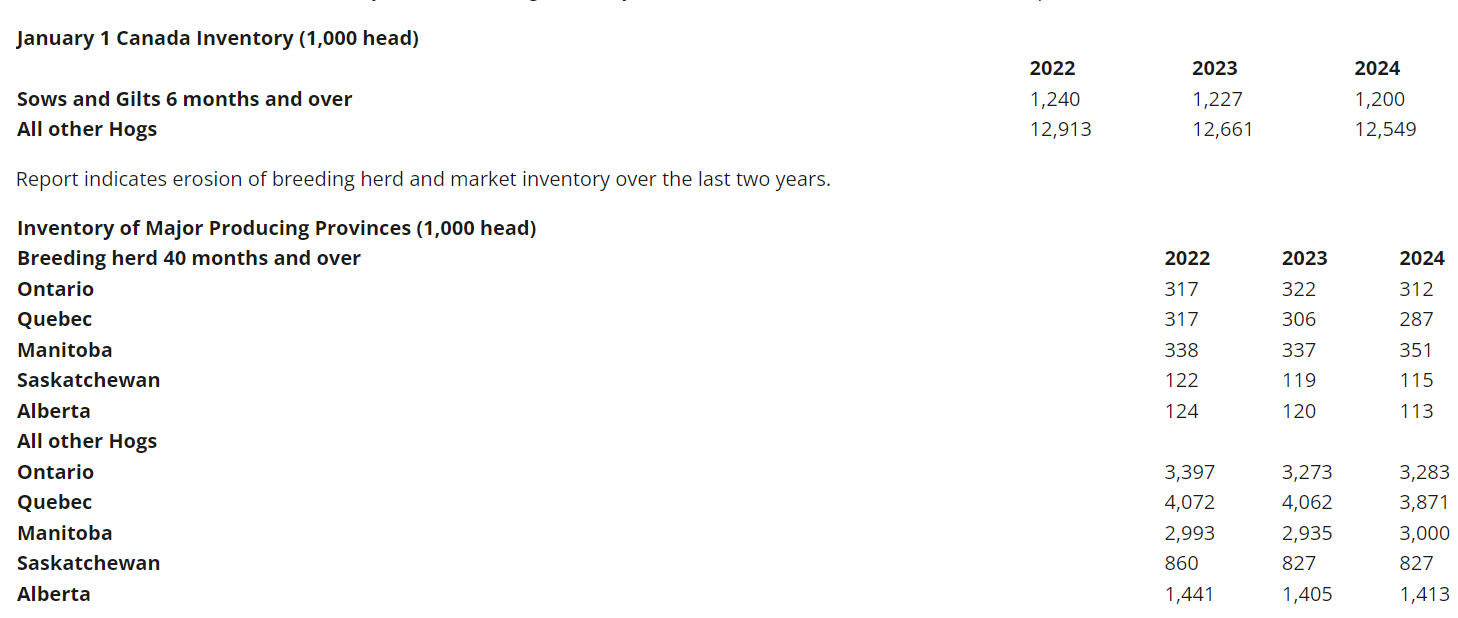

Twice a year the USA – Canada swine inventory is reported for January 1 and July 1. We are in a continental market and the combined inventory reflect supply in a free trade zone.

Observations

The USA – Canada Breeding Herd has declined 526,000 in the last four years. In the last year breeding herd declined 233,000. No doubt a strong indicator on the financial losses incurred in our industry. The market hog inventory of USA – Canada is down 2,125 million compared to 2020 and about 109,000 more than 2023.

The provinces of Ontario, Quebec, Saskatchewan, Alberta down a combined 55,000 in the breeding herd from there two-year peak. Manitoba defies the trend with an increase of 14,000. The same trend with market hogs in the four provinces down, Manitoba up.

Quebec has lost slaughter plants and has a program offering producers financial compensation to leave industry. Quebec data indicates a decline of 30,000 breeding animals (about -10%) over the last two years. We suspect Quebec breeding herd is still declining.

Canada like the United States has had a tough financial situation the last year plus. This has led to financial challenges to many producers. The industry which is not as consolidated at levels as the United States has been supported by independent producers with land base that appreciated in value and the use of grain from on farm production.

Pork Production

Last week USDA raised projected Pork Production in 2024 in there U.S. Meats Supply and Use report. USDA now projecting 2024 U.S. Pork Production at 27,925 million lbs. up from 2023’s 27,316. That’s a 2.3% increase year over year. Year to date U.S. pork production is up 0.7% (5,446 2023, 5,485 2024).

We find it hard to believe how we are going to have a 2.3% increase in pork production with market hog inventories a fraction of a % larger on January 1 than the year before. Also, we have been liquidating sows at a rapid rate in the last six months (we estimate 200 – 250,000 sows). This liquidation will affect the pigs available in the last six months of 2024. If we are only 0.7% higher in pork production year to date, we can’t comprehend the 2.2%. It’s only one week but this past week U.S. pork production was down 2.6% from the same week a year ago.

In our opinion the industry started liquidating in earnest last May highlighted by Smithfield Foods announcement that time of their major downsize in Missouri. May breeding’s are hogs going to market now. Of note not only was pork production down last week it was coupled by lower slaughter weights 290 lbs. vs. 291 lbs. the week before and 292 lbs. a year ago. Last week lower hog numbers and lighter weights. A positive indicator.

Kalmbach Feeds Agribusiness Conference

Last week we attended the Kalmbach Feeds Agribusiness Conference which is annually held in Columbus, Ohio. As usual well attended with speakers of a quality never seen in conferences we usually attend.

Brian Burke of John Stewart and Associates spoke on grain – soybean markets his description of the next couple years of global supply and price points was discouraging to grain farmers in attendance. One thing that stuck with us was the statement that Brazil is adding 2 – 4 million acres of crop land a year, the most striking note was that Brazil has over 90 million acres yet to open up for crop production (none of this is Amazon). That Brazil can grow more in production and already each year seems to capture more of U.S. export markets is very telling.

Donald Miller a marketing expert world renowned spoke. His message in part deliver what customers wants and needs are. Be a solution to the demand. Pork industry hasn’t got the message. Consumers want taste and the industry continues to produce pork that fails to deliver. Last Friday Pork cut-outs 92¢ lb. Choice Beef cut-outs $3.06 lb. The difference in price is consumers voting with their money is a referendum of the taste of each red meat.