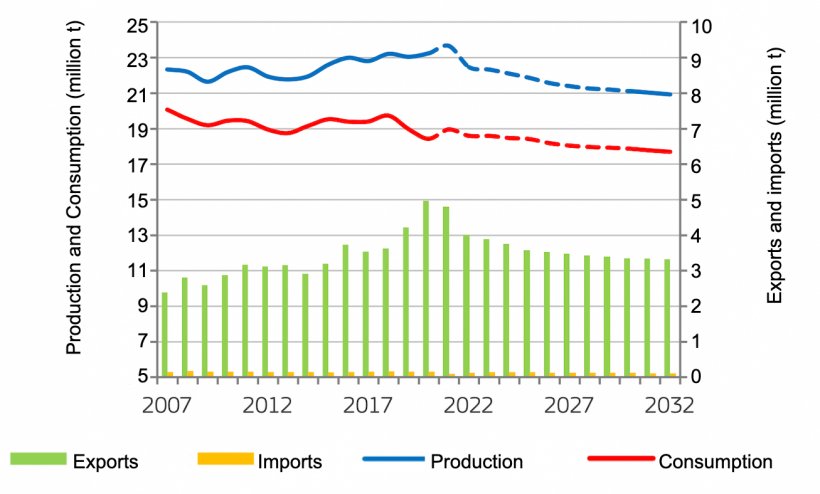

Apparent EU pigmeat consumption is projected to decrease by 0.4% per year, from 32.4 kg per capita in 2022 to 31.1 kg in 2032 (-4% over the whole period). Benefiting from excellent export possibilities to Asia despite African swine fever (ASF), the EU pigmeat sector increased production to 23.7 million t in 2021, but this then fell in 2022. While export opportunities should gradually shrink, ASF will have a lasting effect in the EU. In addition, intensive production systems are likely to face further societal criticism. Combined with stricter environmental laws in certain EU countries, these will have a serious effect on production. Therefore, EU pigmeat production is projected to fall by 1% per year in 2022-2032 (2.2 million t over the whole period).

China’s production capacity is expected to recover sooner than expected. It will therefore drastically reduce its reliance on imports, despite further ASF outbreaks still occurring. Other regions in Asia may take longer to recover. This has a massive impact on EU pigmeat exports which predominantly go to China. In addition, other EU export destinations like Japan, the Philippines, and Vietnam are expected to reduce their imports by 2032. However, markets in South Korea, Australia, Sub-Saharan Africa or neighbouring European countries might create additional opportunities for EU exports. As a result, while EU exports increased by 2.8% per year in 2012-2022, they are projected to decrease by 3.2 % per year in 2022-2032. The EU will also need to strengthen and diversify its export portfolio. Uncertainties remain about the speed of recovery from and trade bans due to ASF. Another possible risk is the spread of ASF to the American continent.

After the price spike in 2022, EU prices should decrease. However, import demand outside China, continuing outbreaks of ASF in Asia, and an adjusting domestic production could slow down the decrease in prices until 2025. EU prices are then expected to remain around EUR 1500/t until 2032.

PigUA.info by materials pig333.com